DRS: Draft Registration Statement

Published on September 19, 2025

As confidentially submitted with the Securities and Exchange Commission on September 19, 2025

This draft registration statement has not been filed with the Securities and Exchange Commission, and all information herein remains strictly confidential.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BDF Holding Corp.

(Exact name of registrant as specified in its charter)

| Delaware | 5712 | 46-4501905 | ||||||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) | ||||||

434 Tolland Turnpike

Manchester, CT 06042

(860) 474-1200

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

William G. Barton

Chief Executive Officer and President

BDF Holding Corp.

434 Tolland Turnpike

Manchester, CT 06042

(860) 474-1200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Craig E. Marcus Rachel D. Phillips Ropes & Gray LLP Prudential Tower 800 Boylston Street Boston, Massachusetts 02199 (617) 951-7000 | Marc D. Jaffe Adam J. Gelardi Latham & Watkins LLP 1271 Avenue of the Americas New York, NY 10020 (212) 906-1200 | ||||

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Smaller reporting company | ☐ | ||||||||

Accelerated filer | ☐ | Emerging growth company | ☐ | ||||||||

Non-accelerated filer | ☒ | ||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is declared effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED ,

PRELIMINARY PROSPECTUS

shares

BDF Holding Corp.

Common Stock

This is the initial public offering of our common stock. We are offering shares of our common stock. We currently expect the initial public offering price to be between $ and $ per share of common stock.

We have granted the underwriters an option to purchase up to additional shares of our common stock within 30 days of the date of this prospectus.

Investing in our common stock involves risk. See “Risk Factors” beginning on page 19 to read about factors that you should consider before deciding to invest in shares of our common stock.

Immediately after the completion of this offering, investment funds advised by Bain Capital and its affiliates (“Bain Capital”) will beneficially own approximately % of our outstanding common stock (or approximately % of our outstanding common stock if the underwriters’ option to purchase additional shares from us is exercised in full). As a result, we expect to be a “controlled company” within the meaning of the corporate governance standards of . See “Management—Controlled Company.”

Prior to this offering, there has been no public market for shares of our common stock. We have applied to list our common stock on under the symbol “ .”

Per share | Total | ||||||||||

Initial public offering price | $ | $ | |||||||||

Underwriting discounts and commissions(1) | $ | $ | |||||||||

Proceeds to us before expenses | $ | $ | |||||||||

__________________

(1)We have agreed to reimburse the underwriters for certain expenses in connection with this offering. See “Underwriting” for additional information regarding underwriting compensation.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock to investors on or about , .

*in alphabetical order

| J.P. Morgan* | Morgan Stanley* | |||||||

| RBC Capital Markets | UBS Investment Bank | |||||||

Prospectus dated ,

EXPLANATORY NOTE

Pursuant to guidance from the United States Securities and Exchange Commission, we are omitting our unaudited condensed consolidated financial statements as of June 29, 2025 and for the six-month periods ended June 29, 2025 and June 30, 2024 because they relate to historical periods that we believe will not be required to be included in the prospectus at the time it is filed publicly. We intend to amend this registration statement to include all financial information required by Regulation S-X in the first public filing of our registration statement.

Table of Contents

We are responsible for the information contained in this prospectus and in any free writing prospectus we prepare or authorize. Neither we nor the underwriters have authorized anyone to provide you with different information, and neither we nor the underwriters take responsibility for any other information others may give you. Neither we, nor the underwriters are making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than its date.

For investors outside of the United States, neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about, and to observe any restrictions relating to, this offering and the distribution of this prospectus outside of the United States.

(i)

ABOUT THIS PROSPECTUS

You should rely only on the information included elsewhere in this prospectus and any free writing prospectus prepared by or on behalf of us that we have referred to you. Neither we nor the underwriters have authorized anyone to provide you with additional information or information different from that included elsewhere in this prospectus or in any free writing prospectus prepared by or on behalf of us that we have referred to you. If anyone provides you with additional, different or inconsistent information, you should not rely on it. Offers to sell, and solicitations of offers to buy, shares of our common stock are being made only in jurisdictions where offers and sales are permitted.

No action is being taken in any jurisdiction outside the United States to permit a public offering of shares of our common stock or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restriction as to this offering and the distribution of this prospectus applicable to those jurisdictions.

Industry and Market Data

Unless otherwise indicated, information in this prospectus concerning economic conditions, our industry, our markets and our competitive position is based on a variety of sources, including information from third-party sources, including independent industry analysts, publications and other independent sources, such as Euromonitor International Limited (“Euromonitor”). Some data and other information contained in this prospectus are also based on our own estimates, research and surveys. This information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such information. Data regarding the industries in which we compete and our market position and market share within these industries are inherently imprecise and are subject to significant business, economic and competitive uncertainties beyond our control, but we believe they generally indicate size, position and market share within this industry. While we believe the information presented in this prospectus is generally reliable, we have not independently verified any third-party information, and our research and estimates have not been verified by any independent source. These and other factors could cause our future performance to differ materially from our assumptions and estimates. As a result, you should be aware that market, ranking and other similar industry data included in this prospectus, and estimates and beliefs based on that data, may not be reliable. Neither we nor the underwriters can guarantee the accuracy or completeness of any such information contained in this prospectus. In addition, forecasts, assumptions, expectations, beliefs, estimates and projections involve risk and uncertainties and are subject to change based on various factors, including those described under “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors.”

Trademarks and Service Marks

This prospectus includes our trademarks and service marks (collectively, “marks”) such as Bob’s Discount Furniture and the Bob’s Discount Furniture logo, which are protected under applicable intellectual property laws and are our property or the property of our subsidiaries. This prospectus may also contain trademarks or service marks of other companies, which are the property of their respective owners. We do not intend our use or display of other companies’ trademarks or service marks to imply a relationship with any other companies, or endorsement or sponsorship of us by any other companies or of any other companies by us. Solely for convenience, the trademarks and service marks referred to in this prospectus are listed without the ®, ℠ or ™ symbols, but such trademarks or service marks may be subject to registration or otherwise protected under applicable intellectual property laws. Any trademarks and service marks included herein are incorporated for illustrative or informational purposes only.

Key Performance Indicators and Non-GAAP Financial Measures

This prospectus contains a number of “non-GAAP financial measures” used by management including Adjusted Net Income and Adjusted EBITDA. These are financial measures that are not calculated or presented in accordance with generally accepted accounting principles in the United States (“GAAP”). For more information about how we use these non-GAAP financial measures in our business, the limitations of these measures, and a reconciliation of these measures to the most directly comparable GAAP measures, please see the sections titled “Summary Historical Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Performance Indicators and Non-GAAP Financial Measures” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Reconciliation of Non-GAAP Financial Measures.”

(ii)

We use these non-GAAP financial measures and key performance indicators (“KPIs”) to supplement financial information presented in accordance with GAAP. We believe that excluding certain items from our GAAP results allows management to better understand our financial performance from period to period. Moreover, we believe these non-GAAP financial measures and KPIs provide our stakeholders with useful information to help them evaluate our operating results by facilitating an enhanced understanding of our operating performance and enabling them to make more meaningful period-to-period comparisons. Adjusted Net Income, Adjusted EBITDA, comparable sales growth, number of new stores and number of stores should not be considered as alternatives to net income or loss, income or loss from operations, or any other performance measure in accordance with GAAP, or as an alternative to cash provided by operating activities as a measure of our liquidity. There are limitations to the use of the non-GAAP financial measures and KPIs presented in this prospectus. For example, our non-GAAP financial measures may not be comparable to similarly titled measures of other companies, including companies in our industry. For a reconciliation of our non-GAAP financial measures to their most directly comparable GAAP financial measures, see the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Performance Indicators and Non-GAAP Financial Measures” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Reconciliation of Non-GAAP Financial Measures.”

Basis of Presentation

The Company reports on a 52- or 53-week fiscal year comprised of 13- or 14-week fourth quarters, with each fiscal year ending on the Sunday closest to December 31. The fiscal years ended December 29, 2024, December 31, 2023 and January 1, 2023, are 52-week fiscal years with 13-week fourth quarters.

References in this prospectus to “fiscal year 2024” refer to the fiscal year ending December 29, 2024, “fiscal year 2023” refer to the fiscal year ending December 31, 2023 and “fiscal year 2022” refer to the fiscal year ending January 1, 2023.

Certain Definitions

Unless the context requires otherwise, references in this prospectus to:

•“AUVs” means average unit volumes, a measure of average sales per store, which is calculated by dividing the total sales across all stores by the total number of stores, and which includes stores opened for at least the last 12 months and excludes sales made through our outlets;

•the “Company,” “Bob’s,” “Bob’s Discount Furniture,” “we,” “us” and “our” refer to BDF Holding Corp. and its consolidated subsidiaries;

•“Comparable sales growth” means our KPI that measures performance during the current reporting period against the performance of the comparable store sales and eCommerce sales in the corresponding period of the previous year. Comparable store sales consist of net revenues from our stores beginning on the first day of the 14th full fiscal month following the store’s opening, which is when we believe comparability is achieved. eCommerce sales consist of net revenues from online purchases during the current reporting period;

•“Number of new stores” means our KPI reflecting the number of stores opened during a particular reporting period;

•“Number of stores” means our KPI that reflects the number of stores as of a particular date;

•“SKU” means stock keeping unit, a unique identifier for each distinct product offered for sale by the Company;

•“YoY” means year-over-year change of the applicable metric as compared to the metric at the same time in the prior fiscal year; and

•“YTD 2025” means the year-to-date period ended September 10, 2025.

(iii)

Prospectus Summary

This summary highlights selected information contained elsewhere in this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in our common stock and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. You should read the entire prospectus carefully, especially “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our audited consolidated financial statements and the related notes, before deciding to buy shares of our common stock. Unless the context requires otherwise, references in this prospectus to the “Company,” “Bob’s,” “Bob’s Discount Furniture,” “we,” “us” and “our” refer to BDF Holding Corp. and its consolidated subsidiaries.

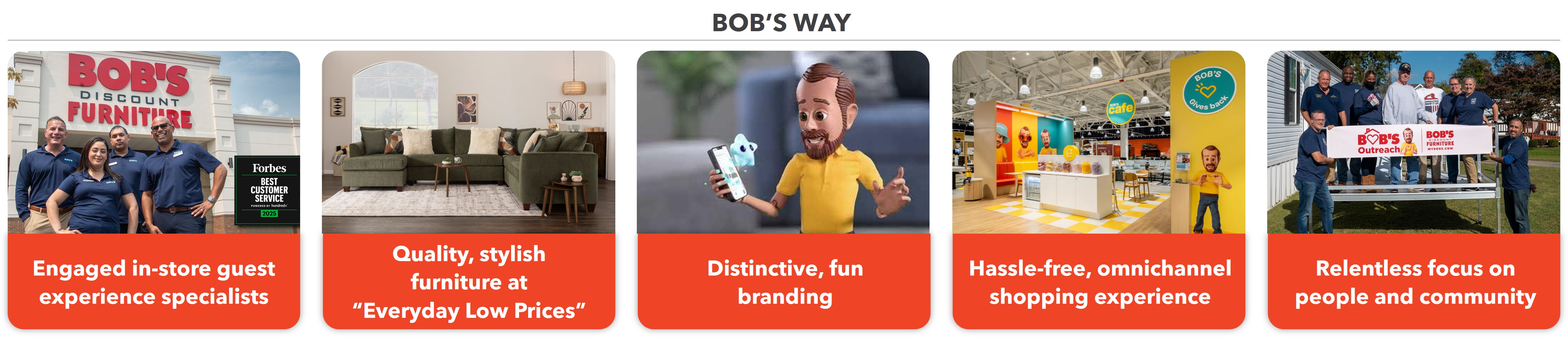

THE BOB’S WAY

“The Bob’s Way” embodies our brand and culture. It’s our unwavering commitment to honesty, integrity, transparency and fun in every aspect of our business – an ethos that has remained unchanged for more than 30 years and continues to be our North Star as we help our customers turn the places they live into the homes they love.

Our Ambition

To become America’s leading omnichannel retailer of quality, stylish furniture at everyday low prices

Our Belief

We can help everyone turn the place they live into the home they love

Our Promise

We deliver value without compromise

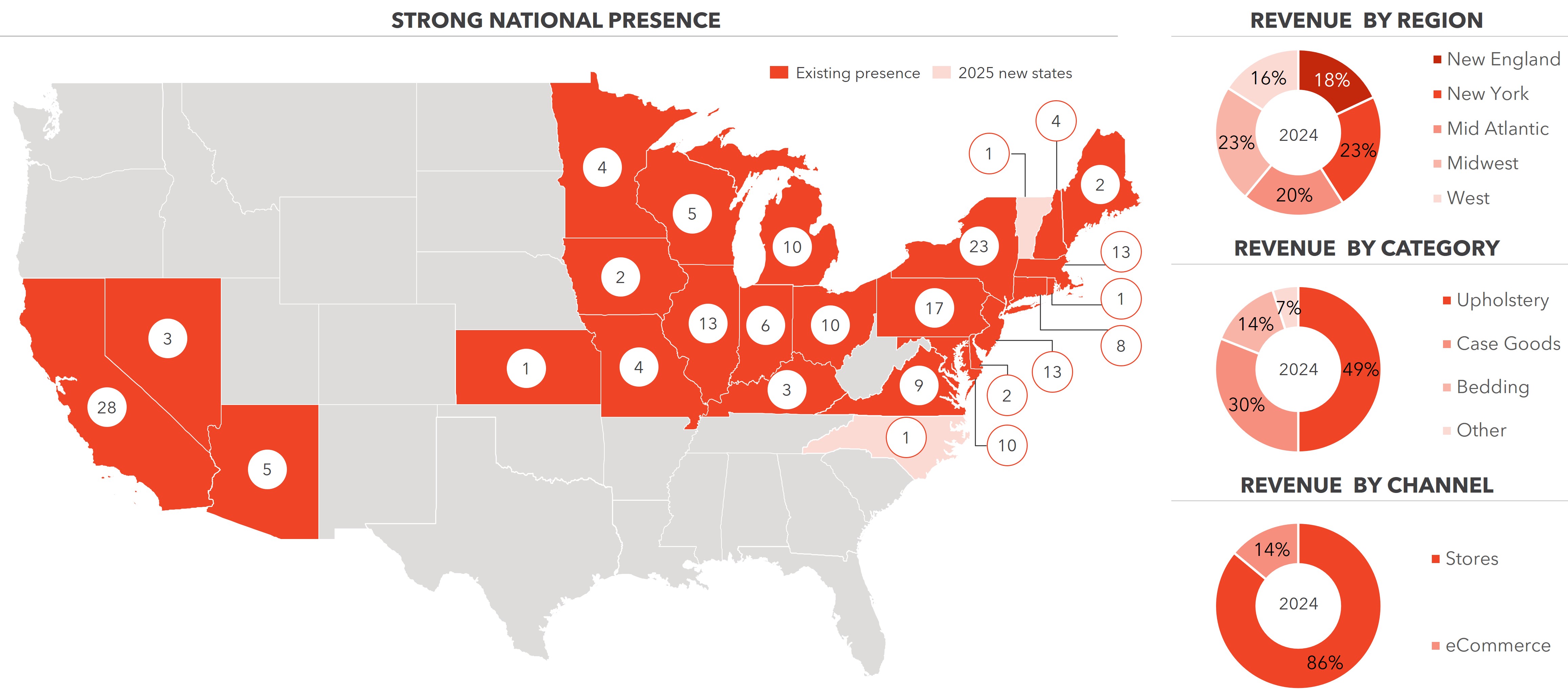

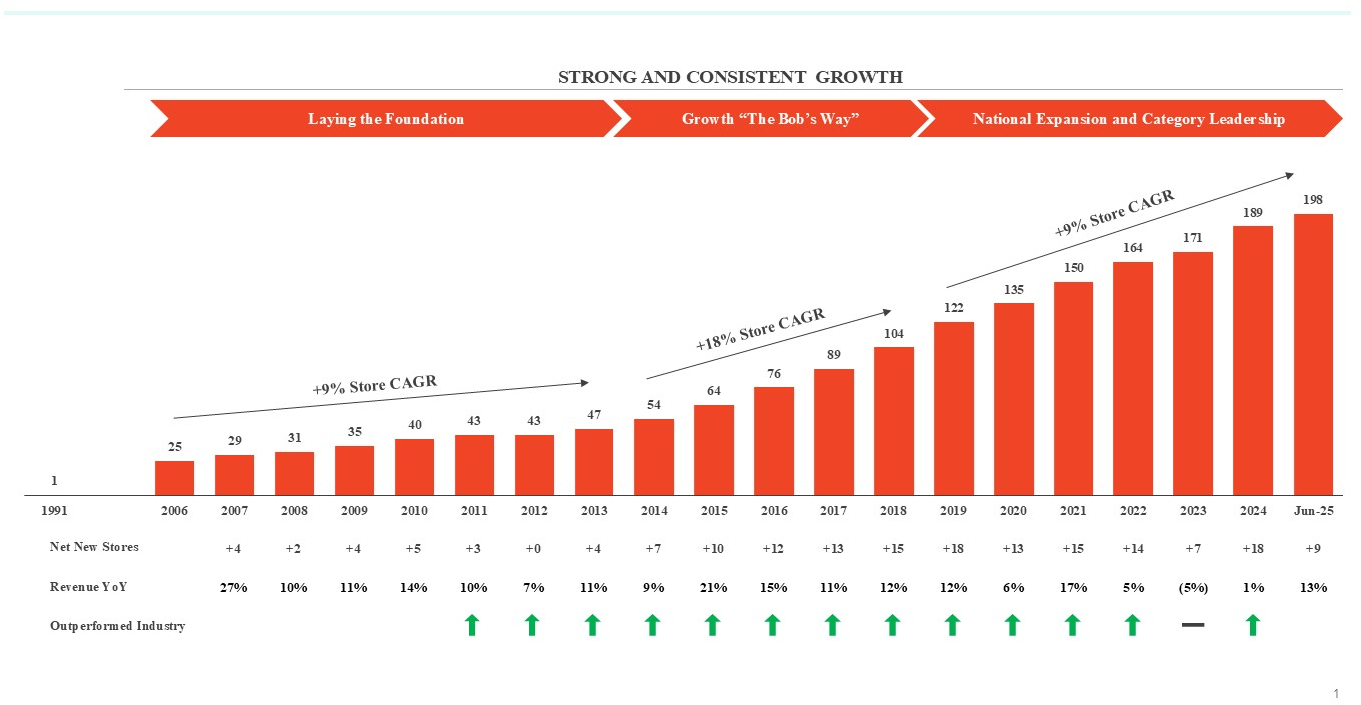

Our Company

Bob’s Discount Furniture is a rapidly growing, nationally proven omnichannel retailer of value home furnishings with 198 showrooms as of June 29, 2025 across 26 U.S. states. Since our founding in 1991, we have built our ethos as a trusted and reliable brand offering superior value and service, without compromising on quality or style. Our business model is anchored in delivering furniture at “Everyday Low Prices,” which we estimate results in our prices being on average approximately 10% below our value-oriented furniture competitors’ lowest promoted prices, which we estimate is equivalent to approximately 20-25% below their listed prices. At the heart of Bob’s success is not just the value of our furniture, but the team members who bring our promise to life every day. From showroom to living room, it’s our people who make Bob’s feel like home.

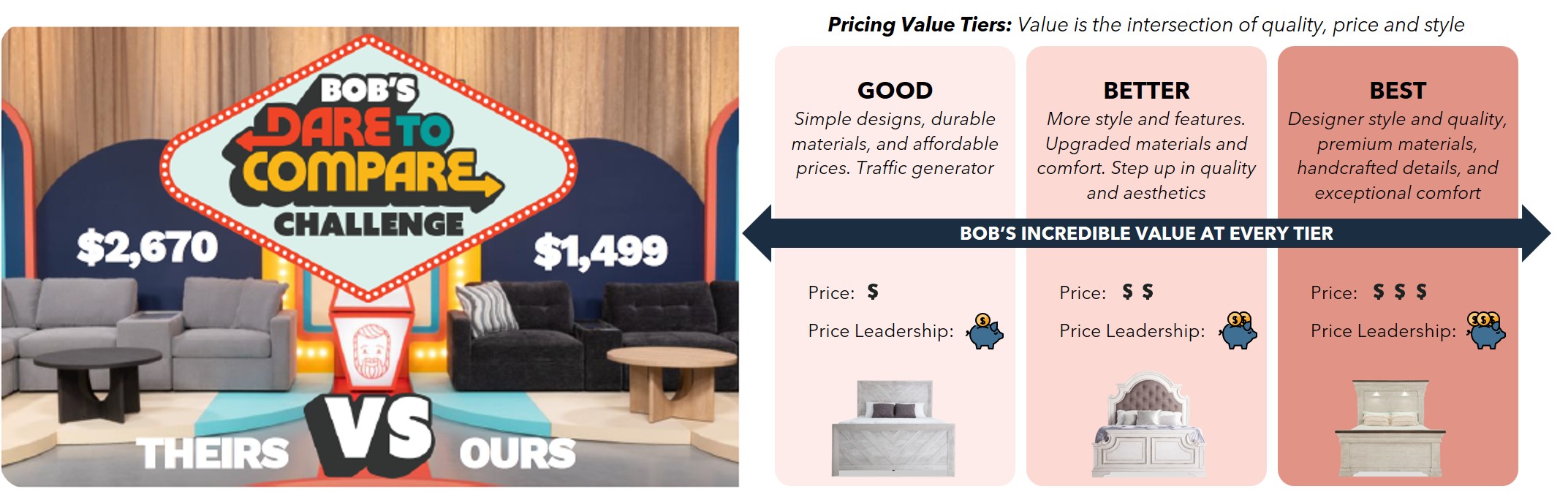

Our value proposition is made possible by our curated merchandising strategy, longstanding sourcing relationships and efficient supply chain. Our merchants target an assortment of products that is narrow and deep, which allows us to drive innovation and cost efficiency. Based on internal estimates, we believe our SKU counts are approximately one-third narrower than our value-oriented furniture competitors. Products are also tailored based on proven market trends and customer demand. Our “Good, Better, Best” assortment strategy ensures we offer customers value at every price point, driving an average order value of approximately $1,400 per transaction, excluding sales at our outlets. Our go-to-market strategy emphasizes a convenient and fun shopping experience,

1

integrated with our online platform and supported by our trained, tech-enabled guest experience specialists. We target our showrooms to average approximately 32,000 square feet and have generated consistently strong store-level financial returns across vintages, geographic regions and population densities.

Our efficient fulfillment process ensures most purchases have the ability to be delivered in as few as three days, rather than weeks, providing customers with a swift and reliable shopping journey. Speed and consistency of customer deliveries are enabled by our vertically integrated logistics network, anchored by five strategically located distribution centers and additional third-party regional depots. Disciplined inventory management ensures product availability matches customer demand and delivery preference, with approximately 86% of orders in YTD 2025 in-stock and ready to be delivered in as few as three days from the time of purchase. Our expeditious delivery timeline and overall convenience are key elements of our value proposition and we believe greatly enhance our overall customer experience.

Over the past decade, we have made substantial investments in our omnichannel capabilities, enabling a seamless shopping experience across digital and physical platforms. Customers can shop online, in-store, over the phone and via our mobile app, with unified shopping cart functionality and consistent service quality. Approximately 75% of Bob’s customers engaged with us across multiple channels in the first half of fiscal year 2025, reflecting the strength of our integrated platform. To deliver this seamless customer experience, we leverage a highly integrated operating system that draws on the same inventory, pricing and logistics network whether our customers buy in-store or online. We believe our momentum, combined with our scale, enjoyable showroom and omnichannel journey, favorably positions us to grow profitably and continue to increase market share.

We believe there remains significant opportunity to expand our store base in both existing markets and new geographies. Our growth strategy is fueled by significant and proven whitespace potential, a disciplined market entry playbook and attractive unit economics, with new stores historically generating rapid payback periods and 80+% cash-on-cash returns. Our growth is guided by a disciplined playbook that informs what markets to enter and how to enter them. We focus our expansion on areas with strong furniture demand, particularly where there are existing furniture stores, to optimize capture of qualified customers in the market. Our brand and business model has resonated across market sizes and with a diverse range of customers. As our brand awareness grows in new and existing markets, our demand increases, which in turn allows us to invest even more heavily in customer awareness and thus continually drive stronger store performance. With a proven name, a loyal customer base and a business model designed to generate high returns on capital, we believe that we are well-positioned to expand our store base to more than 500 stores in our existing format by 2035, as described in more detail below.

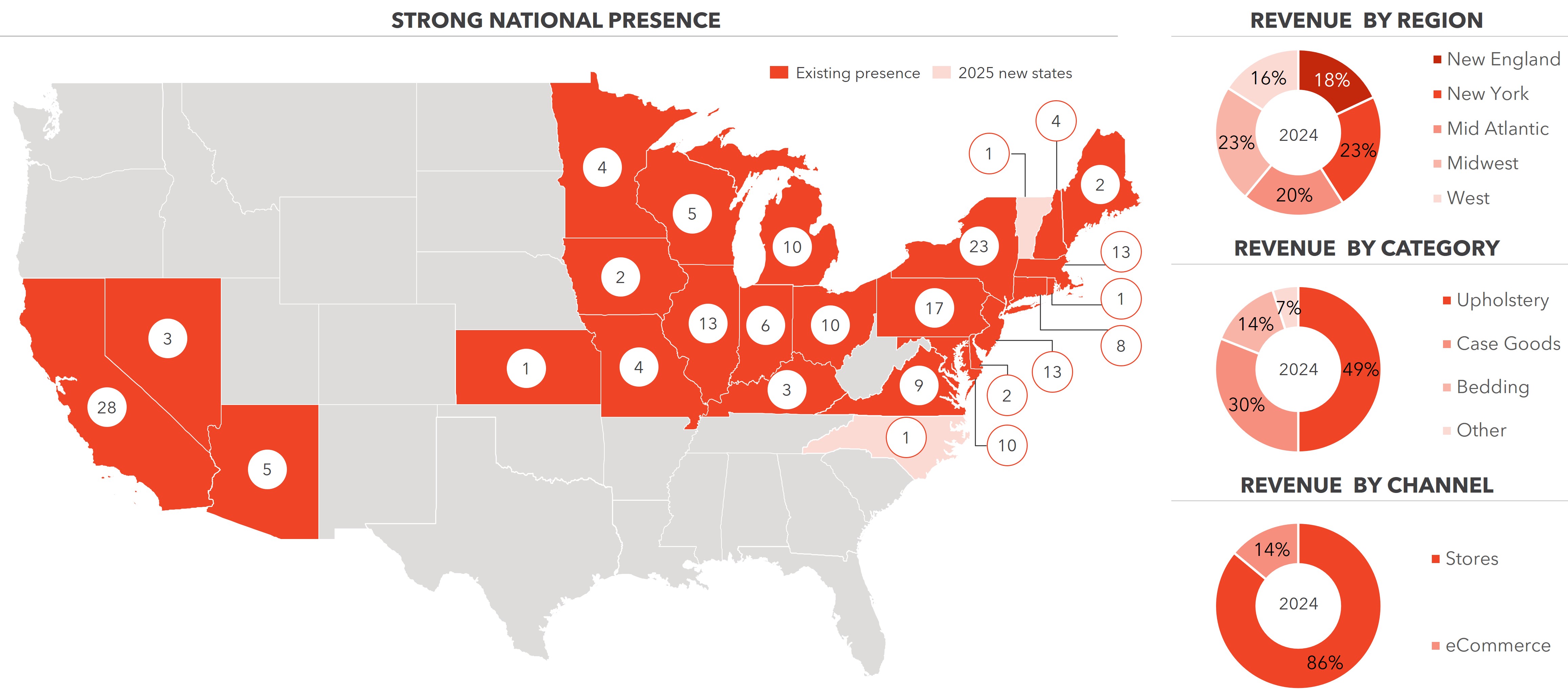

Map reflects data as of June 29, 2025; Revenue data for fiscal year 2024

2

Our belief that everyone deserves a home they love is reflected in how we operate daily and the appreciation we have for our people and communities. From our in-store guest experience specialists who create a no-pressure, no-gimmicks shopping experience, to our distribution and logistics teams who enable fast, reliable fulfillment, Bob’s is built on the dedication of more than 5,800 team members nationwide, as of September 10, 2025. By investing in training, promoting collaboration and rewarding accountability, we foster a culture that creates long-term loyalty to Bob’s, exemplified by an attractive average tenure of approximately seven years for our store managers. Our unique marketing, in-store experience and community engagement all focus on a friendly and relatable work environment that we believe makes working at Bob’s less intimidating and more enjoyable.

Bob’s has a foundational commitment to supporting our communities. Our complimentary in-store cafés are home to our “Café Collections for a Cause” initiative where Bob’s will match every customer dollar donated to a featured charity, up to $75,000. In addition, as part of every new store opening, we donate to a local nonprofit organization and school during the store’s ribbon cutting ceremony. Investing in our communities is deeply integrated into who we are.

Recent Financial Performance

Our strong financial performance reflects the strength of our brand strategy and is highlighted by having:

•Increased store base by 10.5% from 171 units as of December 31, 2023 to 189 units as of December 29, 2024

•Increased net revenue by 1.0% from $2,008 million in fiscal year 2023 to $2,028 million in fiscal year 2024

•Improved net income by 12.6% from $78 million in fiscal year 2023 to $88 million in fiscal year 2024

•Adjusted EBITDA of $195 million in fiscal year 2023 compared to $194 million in fiscal year 2024, representing a decrease of 0.5%

See “Summary Consolidated Financial and Other Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Performance Indicators and Non-GAAP Financial Measures” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Reconciliation of Non-GAAP Financial Measures” for additional information regarding our financial performance and non-GAAP financial measures, together with a reconciliation of non-GAAP financial measures to their most directly comparable GAAP measures.

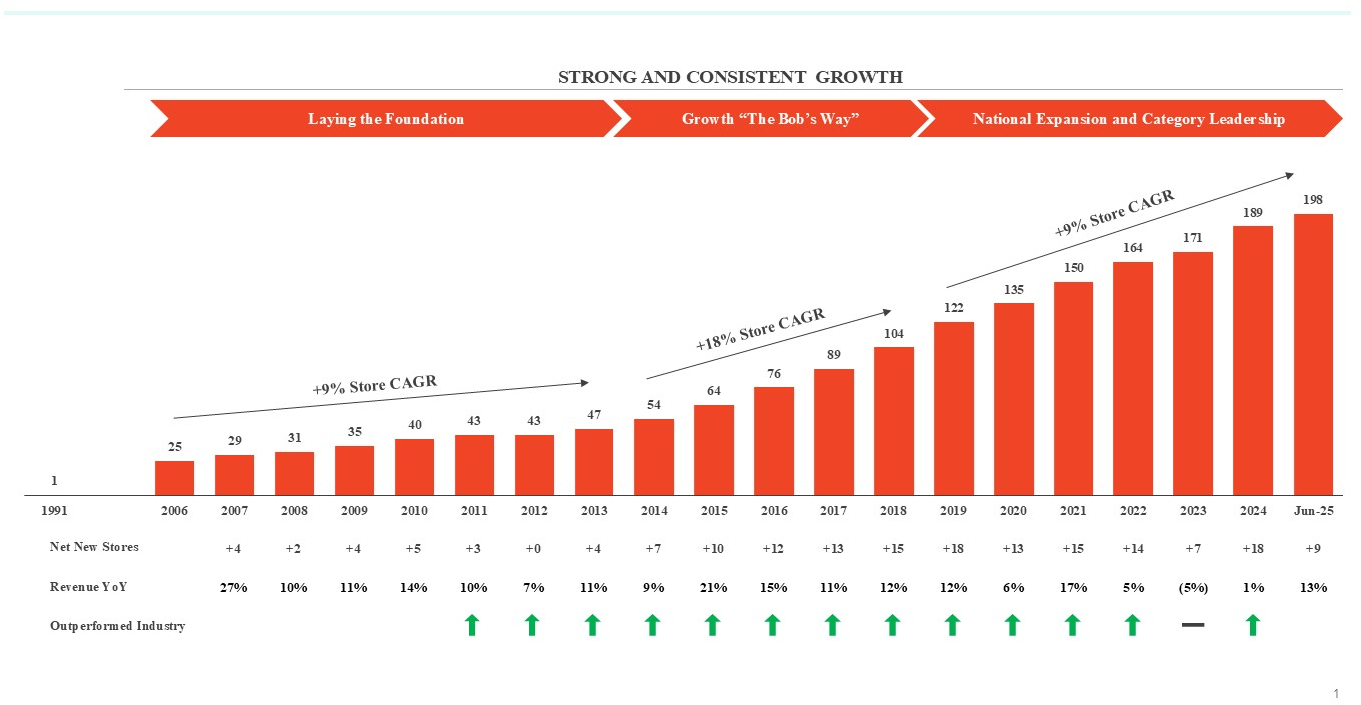

Our focus on value positions us well within the expansive and fragmented $182 billion U.S. home furnishings industry (excluding barbecues) in 2024, as defined by Euromonitor, allowing us to capture significant share by appealing to customers seeking quality, style and affordability. Bob’s has grown faster than the home furnishings industry (excluding barbecues) in each of the last 14 fiscal years, with the exception of fiscal year 2023, based on Euromonitor data. Since fiscal year 2010, Bob’s has grown at a compound annual growth rate (“CAGR”) of approximately 9%, which is over 680bps faster than the home furnishings industry (excluding barbecues), which grew at a CAGR of approximately 3% during the same period, based on Euromonitor data. This sustained outperformance underscores our ability to effectively navigate market and macroeconomic dynamics, capitalize on customer demand, and take share.

The home furnishings industry is sensitive to interest rates and housing activity. In 2020 and 2021, the COVID-19 pandemic served as a tailwind to the home furnishings industry, which drove a surge in demand as consumers adapted to a “stay-at-home” lifestyle. This resulted in market-wide pull forward, which led to a subsequent slowdown in the industry in the following years that was further exacerbated by increased interest rates and inflation. Bob’s has emerged stronger following this cycle and continues to show resilience and outperformance compared to the home furnishings industry. For example, in fiscal year 2024 Bob’s revenue growth surpassed the home furnishings industry (excluding barbecues) by over 700bps on a YoY basis, and we plan to continue to build on that momentum through fiscal year 2025. As interest rates and inflation normalize, housing turnover and new residential construction are expected to accelerate, creating a favorable demand backdrop. Bob’s has proven its

3

ability to outperform industry benchmarks even through recent headwinds, underscoring the durability of our model and positioning us to capture incremental upside as conditions improve.

Reflects data as of June 29, 2025

“OH MY BOB!” - KEY DRIVERS OF OUR SUSTAINED SUCCESS

We believe the following strengths differentiate us from our competitors:

A Proven, Scaled Brand Delivering Value Without Compromise

Bob’s is rapidly becoming Where America Shops for Furniture™ by consistently delivering unparalleled customer experiences at every stage of the furniture purchasing journey. Customers know they can count on Bob’s for quality, stylish furniture at everyday low prices. Consistently delivering on that promise has made Bob’s a trusted name in homes across the country. Our store experience customer satisfaction rating is 90%+, based on our internal customer survey data, which reflects the loyalty we’ve built over nearly thirty-five years.

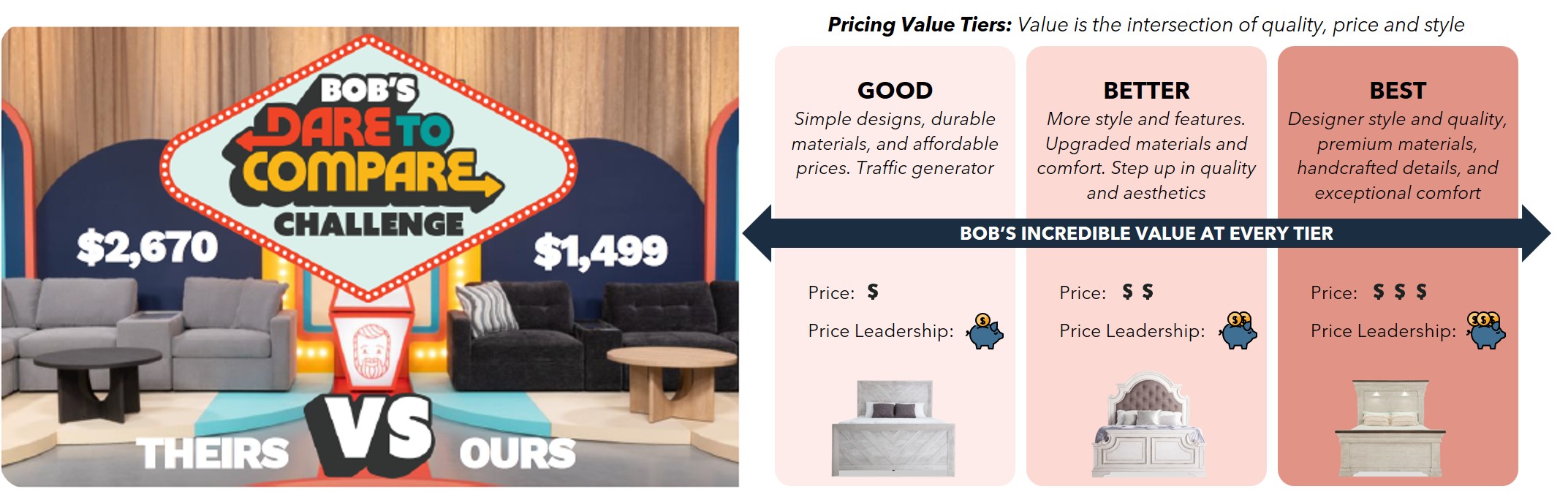

The Bob’s brand comes to life in every part of our business. From breakthrough and memorable marketing campaigns like Oh My Bob!, Dare to Compare and an industry first reality series Till Décor Do Us Part, to the complimentary snacks in our in-store café, every aspect of the shopping experience is designed to be differentiated and customer-centric. We believe our fun and authentic brand image, compelling value and best-in-class, low-pressure service resonate with our customers and define Bob’s as a unique and comfortable destination for furniture shopping.

Our dedicated team members deliver un-rivaled service “The Bob’s Way”. Our people-first approach builds customer trust and fuels our growth. Between our customer-centric service, tech-enabled omnichannel experience, and our trusted brand, we believe that we continue to resonate with customers on a national scale.

Highly Differentiated Merchandising, Sourcing and Logistics Infrastructure

Bob’s has established a sophisticated and highly differentiated product, pricing, sourcing and supply chain strategy that drives our go-to-market strategy.

4

Product

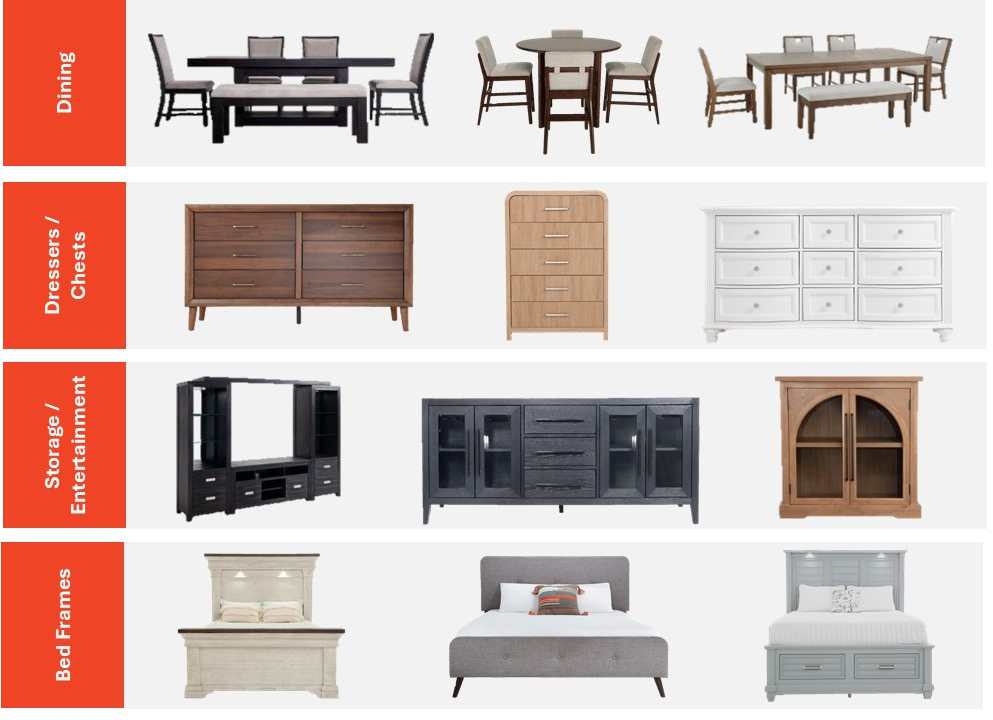

Our merchandising philosophy is to consistently deliver stylish, high-quality furniture at unbeatable value, with everyday low prices customers can trust. We have developed a curated product offering by gaining a deep understanding of customer needs and preferences which enables us to be a follower of new and emerging trends. Our streamlined assortment appeals to a broad range of customers by featuring timeless classics, innovative designs and tech-enabled alternatives that adapt to evolving customer tastes. Our product architecture of “Good, Better, Best” provides a clear framework for delivering maximum value to a diverse customer base. The “Good” value tier provides a reliable foundation of essential and durable products, while our “Better” tier introduces additional functional capabilities, upgraded materials and styles. Our “Best” product tier integrates premium materials, craftsmanship and quality with elevated designer inspired style. We have a focused merchandising strategy built around a narrow and deep SKU model that we estimate is approximately one-third narrower than our value-oriented furniture competitors. This model allows us to concentrate purchasing volume on high-velocity items, negotiate aggressive pricing and reduce our inventory risk.

For illustrative purposes; prices and assortment are illustrative as of June 29, 2025

Pricing

Bob’s offers a differentiated customer proposition rooted in delivering value without compromise. Our sophisticated pricing strategies underpin our everyday low price model, enabling us to offer prices which we estimate are on average approximately 10% below our value-oriented furniture competitors’ lowest promoted prices, which we estimate is equivalent to approximately 20-25% below their listed prices. We do not rely on promotions or sales gimmicks. Instead, we offer transparency and trust – elements that resonate with today’s value-conscious consumer. As customers ascend our “Good, Better, Best” product architecture, we believe that our relative value increases, enhanced by everyday low price bundle and save offerings particularly in bedroom categories to increase

5

units per transaction. Incremental enhancements in quality, features, functionality and style are strategically priced to deliver superior customer value across the full spectrum of price points.

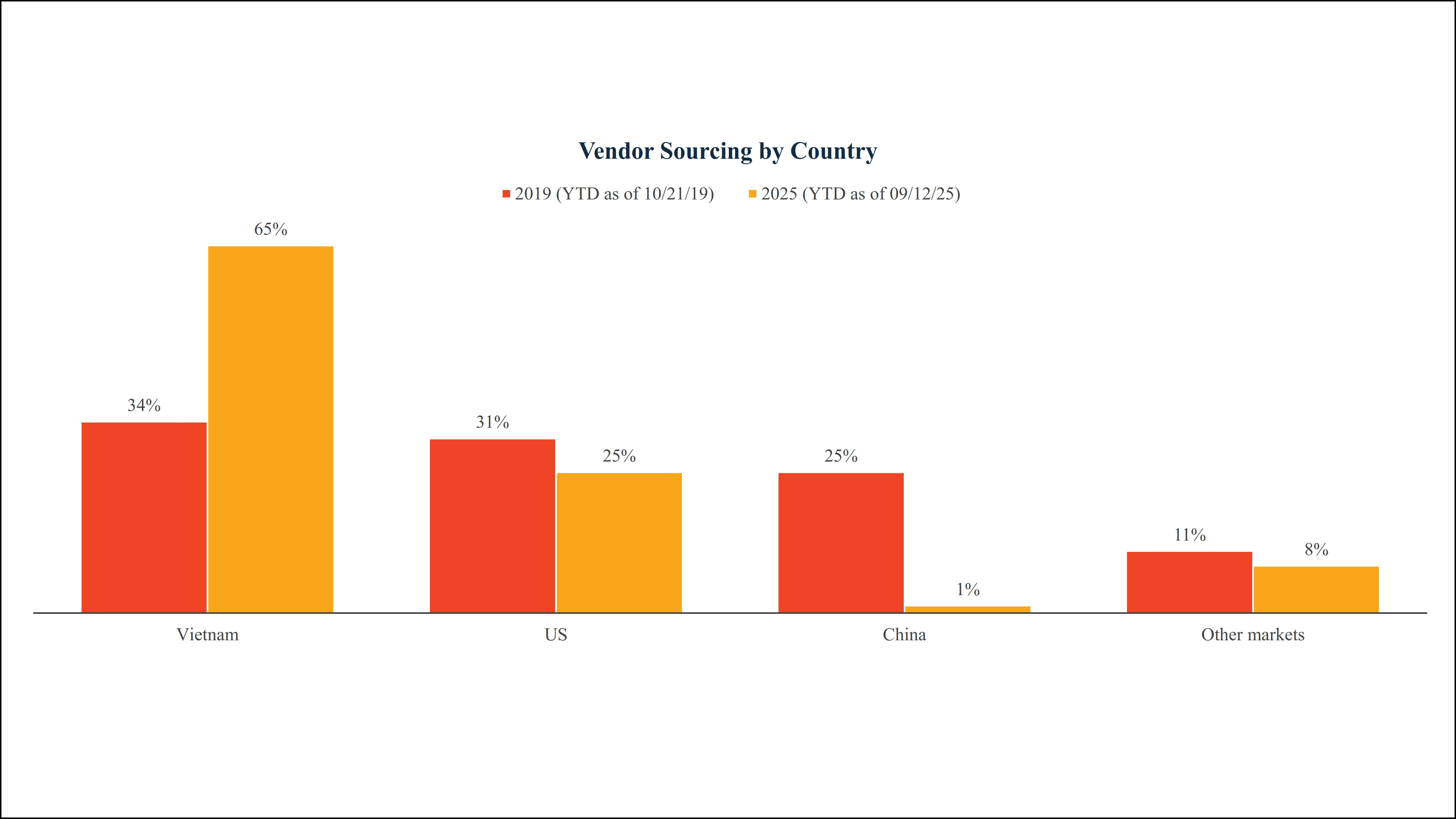

Sourcing

Our value leadership is driven by buying power, a streamlined assortment of products, and strategic vendor relationships extending in some cases nearly 15 years. Our everyday low price model ensures consistent, year-round order volume for suppliers, enabling them to maintain steady production and improve their efficiency. We believe that the combination of scale and consistency positions us as the first partner of choice for our suppliers. We leverage this advantage, along with long-standing strategic relationships, to drive cost optimization, innovation, and speed-to-market. Our flexible sourcing strategy enabled us to move all key production out of China by the end of fiscal year 2024, mitigating known tariff risk, while preserving the ability to pivot as circumstances evolve. Today, our primary sourcing markets are Vietnam and the United States, representing approximately 65% and 25% of our product cost volume, respectively as of September 10, 2025, with smaller sourcing markets in Thailand, Malaysia and Cambodia. This unique blend of scale, consistency, strategy, and relationship management allows us to remain nimble and responsive to changes in the macro landscape.

Supply Chain

We believe swift and reliable delivery service complements our customer shopping experience. We are not satisfied until every customer sees their furniture at home exactly as they experienced it in our showroom. Recognizing customer sensitivity to product availability, we target and have maintained an in-stock rate of approximately 86% in YTD 2025, which allows guest experience specialists to offer prompt and reliable delivery in as few as three days. Our BOBtastic delivery options offer a range of services tailored to meet our customers’ needs, from white glove delivery to quick pickup.

We manage the distribution and delivery of our products through our five distribution centers and 44 third-party delivery depots as of June 29, 2025, located strategically in markets throughout the United States. These systems allow our customers to have most products delivered to them in as few as three days, rather than weeks, as well as schedule delivery around their availability and preference; during fiscal year 2024, 55% of orders were delivered to customers in seven days or less and 76% of our orders were delivered in two weeks or less. Our consistent store and delivery customer satisfaction ratings reflect the seamless customer experience from showroom to living room.

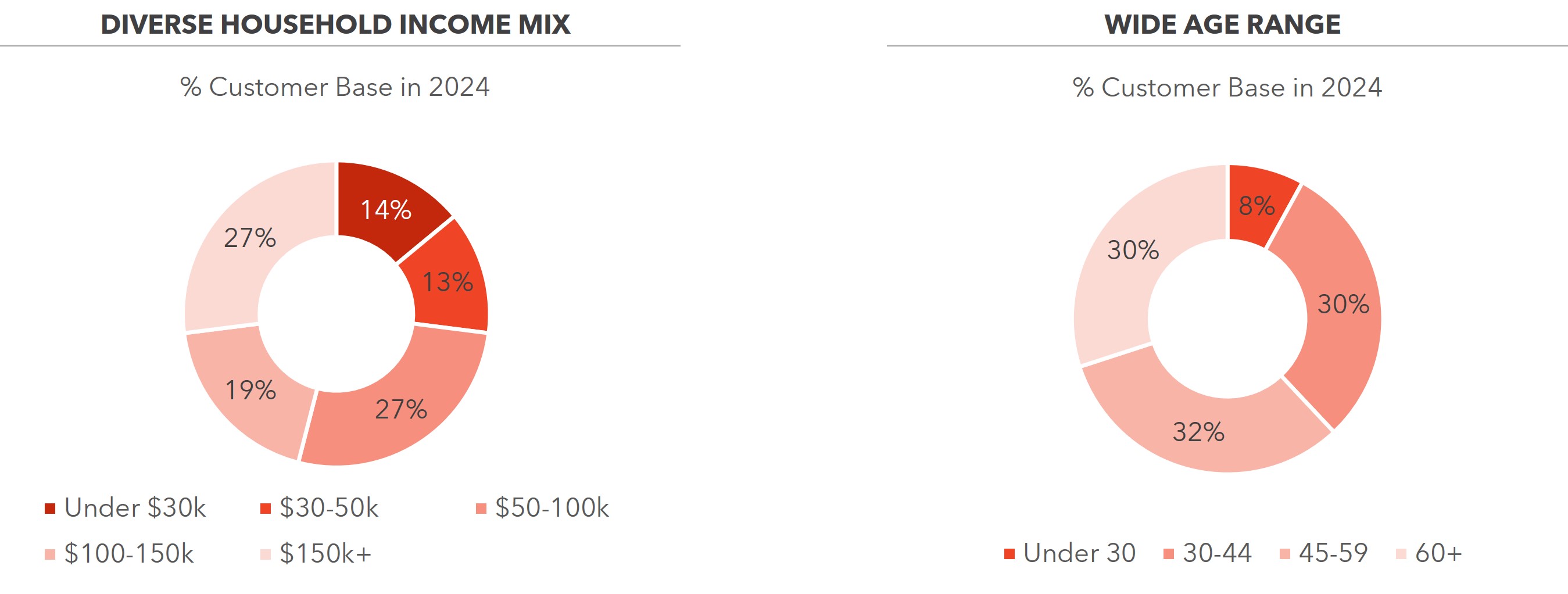

Broad Customer Appeal

We have scaled successfully across markets around the country, including urban, suburban and secondary trade areas, and appeal to a diverse customer base. Our offerings cater to both budget-conscious families as well as higher-income households seeking furniture at a great value. This approach allows us to serve our customers across all purchasing occasions, including important life milestones.

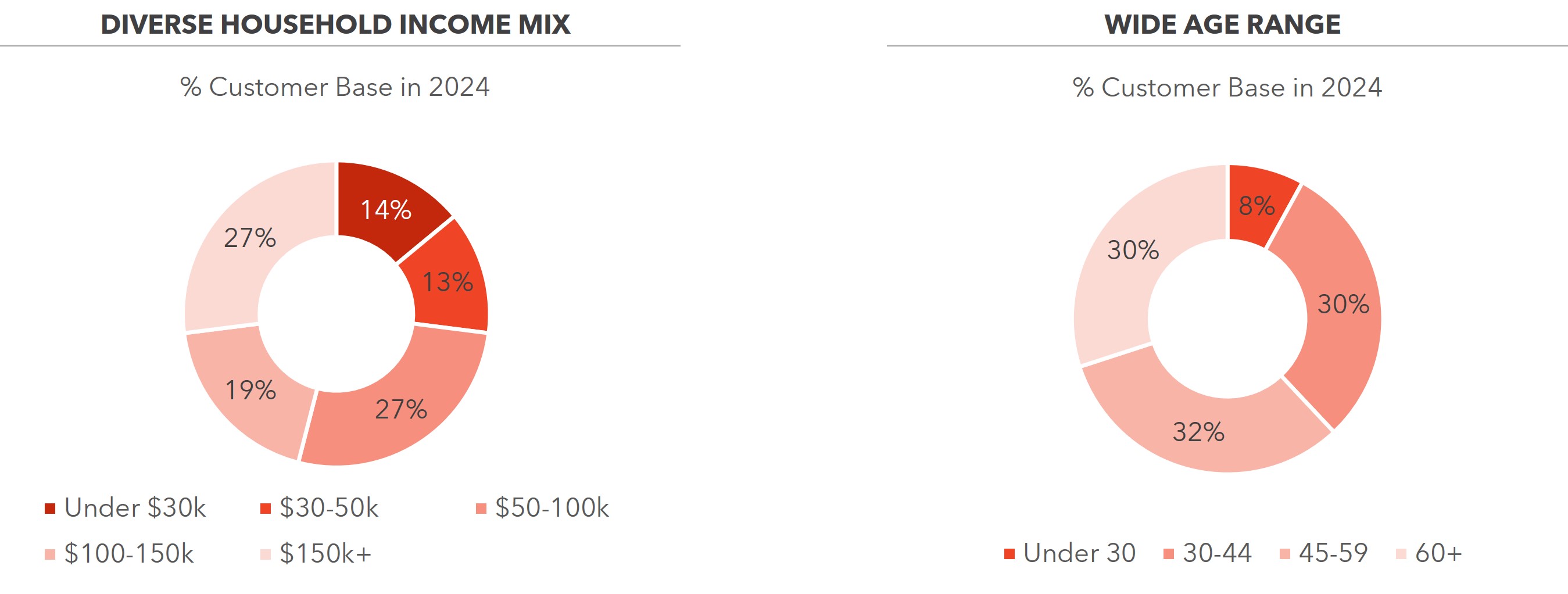

In fiscal year 2024, approximately 46% of our customers had household incomes over $100,000, and approximately 27% earned above $150,000. Our appeal spans generations, with customers aged 30-44 representing

6

approximately 30% of our total fiscal year 2024 customer base, 45-59 at approximately 32%, and 60+ at approximately 30%. This wide appeal reflects the strength of our value proposition and supports our geographic and digital expansion.

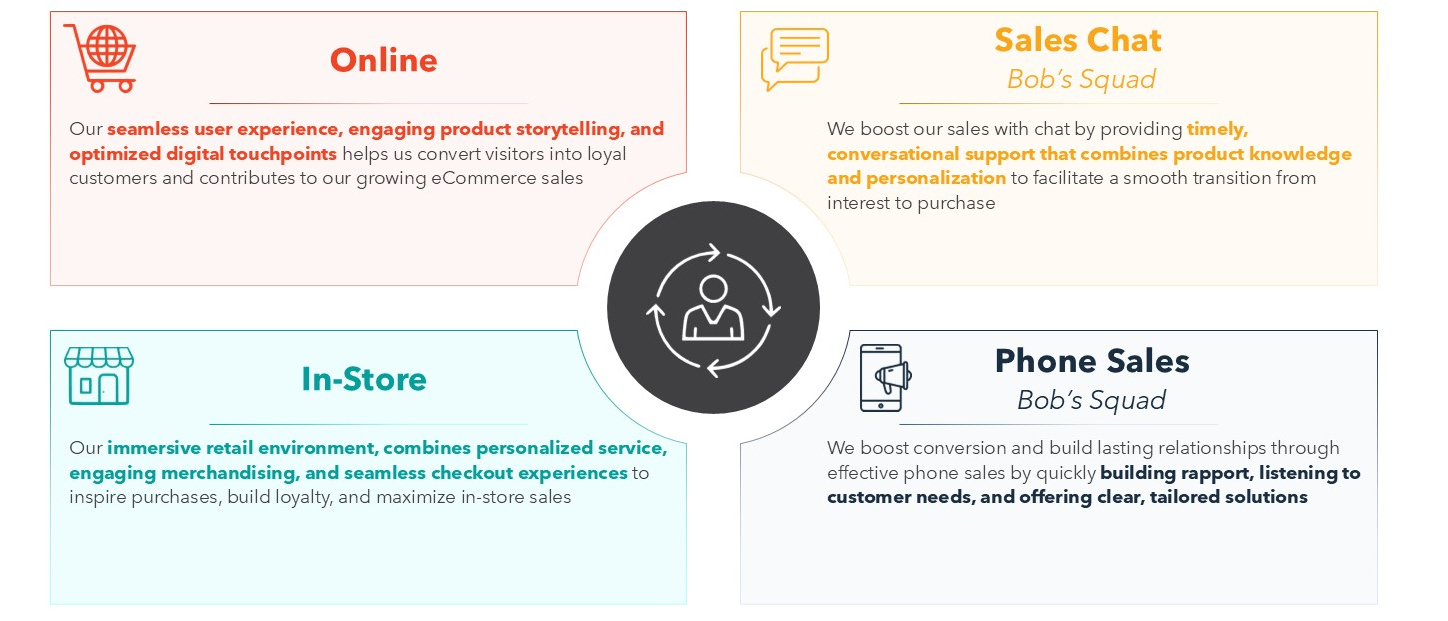

Omnichannel Platform Driving End-to-End Customer Engagement

At Bob’s, we are committed to delivering a seamless shopping journey across all touchpoints (showrooms, phone, online, webchat), ensuring our customers can access our quality furniture wherever and however they prefer. Our strategy is built on a channel-neutral philosophy, operating as one highly integrated backend system across inventory management, pricing, fulfillment, merchandising and supply chain logistics. Our technology structure is similarly integrated across our platform enabling us to utilize advanced data analytics and technology to connect with customers across our various channels during the course of a highly considered purchase cycle.

Differentiated In-Store Experience

We greet each of our guests with the phrase “Welcome to Bob’s, would you like to look around?” We believe this is the beginning of a welcoming, hassle-free shopping experience with no gimmicks, reflecting our core promise of value without compromise. Our stores are designed to be engaging and helpful, with layouts that group comparable products and feature visual displays to enable discovery. Bob’s low-pressure sales environment encourages customers to browse freely and comfortably, creating a relaxed and fulfilling shopping experience, particularly when compared to a more traditional furniture buying experience led by high-pressure sales associates. We believe that our showrooms serve as a powerful catalyst for accelerating brand awareness and deepening customer engagement and loyalty.

Our guest experience specialists are knowledgeable, friendly and equipped with personal tablets, leading to efficient service and driving conversion. The tablets enable real-time product recommendations, stock visibility and allow our team members to offer a broad range of Bob’s comprehensive selection, including various styles, colorways and add-ons. Every store includes a café with fun, complimentary amenities that enhance the retail adventure and reinforce our brand’s approachable and customer-first ethos. While approximately 75% of our customers engaged with us through multiple channels in the first half of fiscal year 2025, approximately 86% of our revenue was converted in-store, showcasing the effectiveness of our showroom strategy.

Online Platform

Our eCommerce channel represented approximately 14% of total net revenue in fiscal year 2024. Our website, mybobs.com, complements our stores by offering customers convenient access to our full product lineup and generates incremental traffic to our physical locations. Enhanced by AI-driven search tools, product recommendation algorithms, virtual visualization capabilities and an AI chatbot, our online presence allows customers to research, explore and purchase with confidence. Our OmniCart technology creates a seamless experience across channels, enabling customers to build and transfer shopping carts between online and in-store

7

touchpoints. This system provides customers with flexibility to begin their journey digitally while transacting in person, or vice versa, designed to ensure a consistent, frictionless experience across platforms. Together, our store and eCommerce platforms form a cohesive, tech-enabled ecosystem.

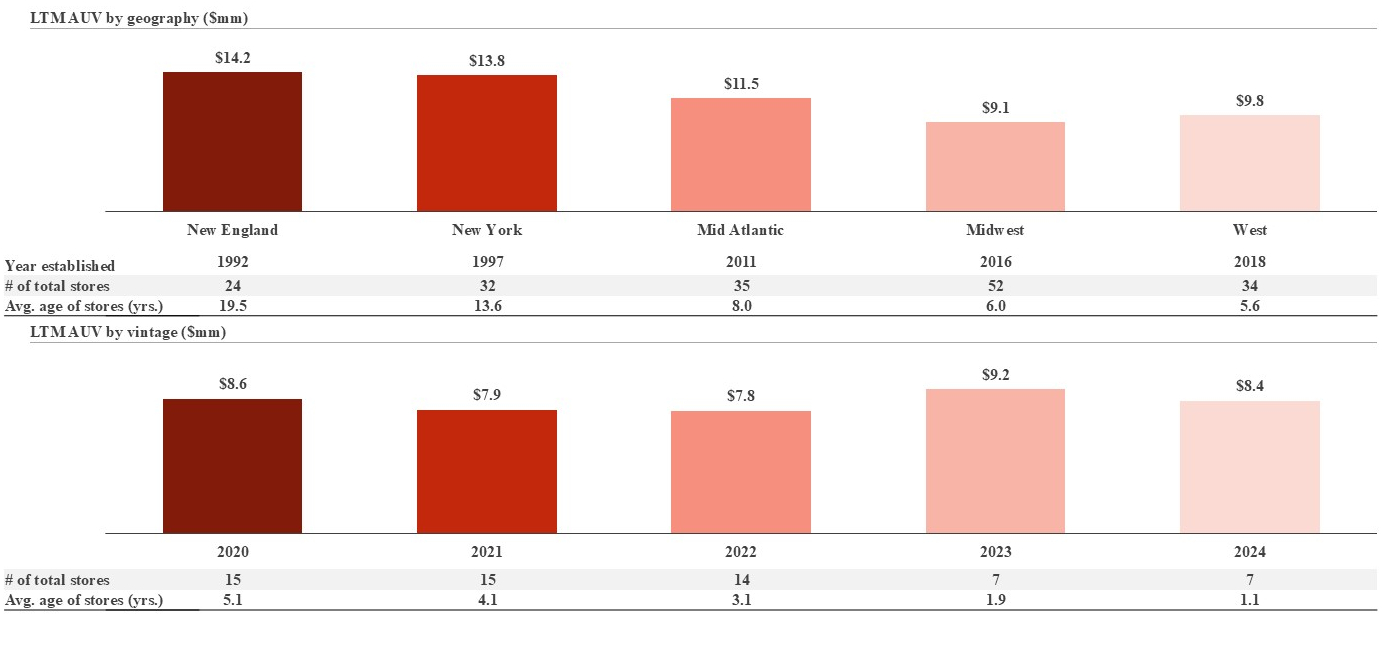

Attractive Unit Economics with Proven Portability Across Markets

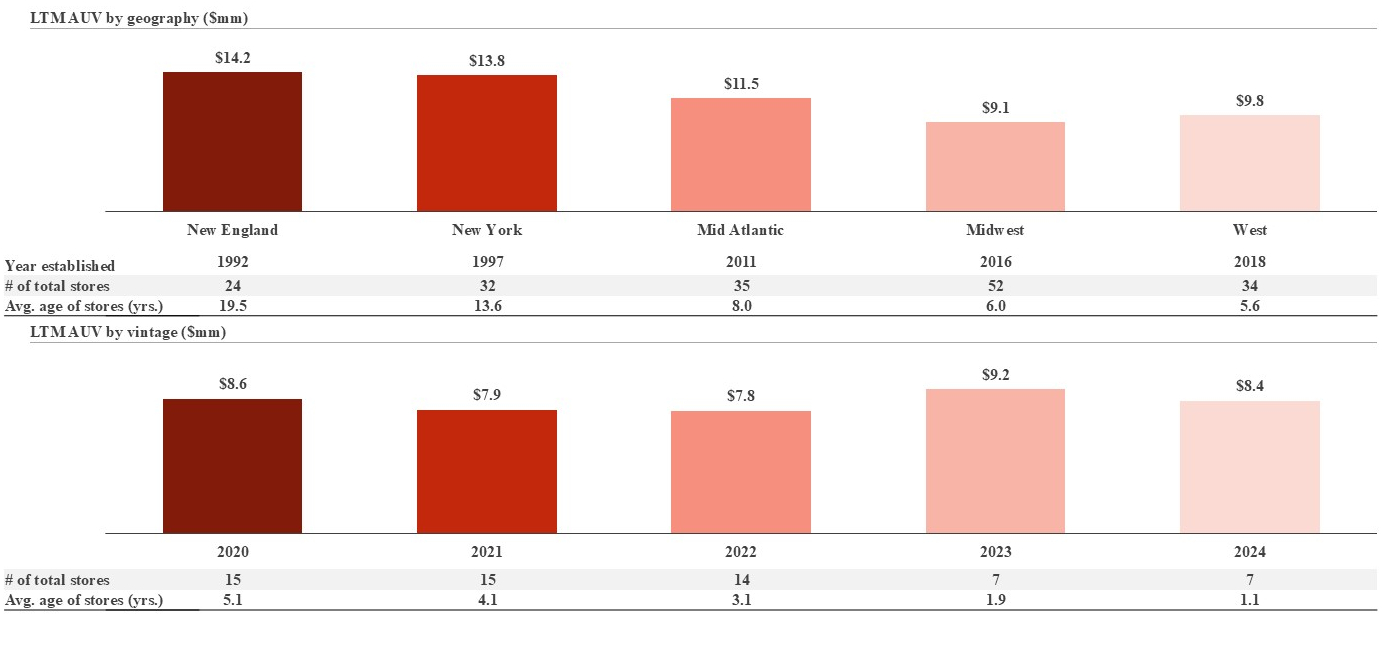

Our ability to successfully enter, and prosper in, a wide variety of markets is a testament to the strength of our business model and strategic execution. As of June 29, 2025, we operated 198 showrooms across 26 states, delivering strong unit economics in both legacy markets and the regions into which we have more recently expanded. Mature regions such as New England and New York, first established in 1992 and 1997, have demonstrated AUVs of approximately $14 million. Our top five New England and New York stores have generated AUVs of approximately $20 million and approximately $22 million, respectively, for the 12 months ended June 29, 2025. Our newer stores continue to show strong progress, with recent cohorts either already exceeding or near our current AUV target in less than two years.

LTM AUV calculated for the 12-month period ended June 29, 2025; Average age of stores calculated as of June 29, 2025; Excludes outlet sales, closed stores and stores opened after June 29, 2024

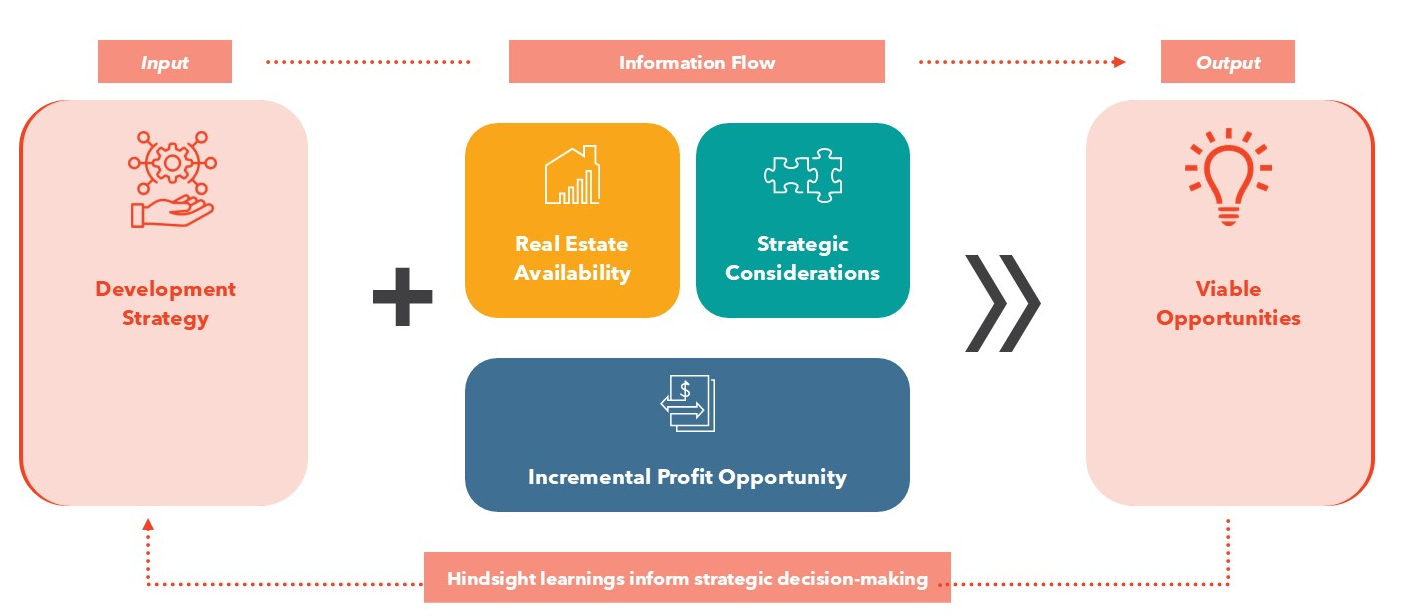

Our development strategy involves an ongoing assessment of whitespace growth potential and extensive analysis of factors such as real estate availability, competitive market dynamics, zone pricing and return on investment (“ROI”) targets. Our robust, cross-functional development process ensures that each new market entry and store opening is thoughtfully planned and highly customized to best serve local customer needs. By maintaining a disciplined approach to expansion and leveraging our proven market entry strategies, we believe that we are well-positioned to continue our successful growth trajectory across new and existing markets. As we continue to expand, we remain committed to delivering the best-in-class experience that our customers have come to expect from Bob’s.

Experienced and Dedicated Team Enabling The Bob’s Way

The heart of our organization is our people, who form the foundation of our success. Our management team has cultivated a motivated, people-first culture of approximately 5,800 employees, as of September 10, 2025, committed to delivering outstanding customer experiences The Bob’s Way. Our company culture is an integral part of our strategy, and we have had great success developing inspiring leaders, rewarding top performers and maintaining best-in-class employee satisfaction amongst our retail peers. Our commitment to our team is best exemplified by an attractive average tenure of approximately seven years for our store managers, with 81% of open store manager roles filled in fiscal year 2024 by internal promotions. Our focus on leadership development ensures opportunities for our next generation of managers as well as cohesion and continuity of Bob’s values. This enduring loyalty has enabled us to build lasting relationships with customers and foster an environment that empowers team members to excel.

8

We believe that our company culture is a key competitive advantage and a strong contributor to our success, and we have prioritized maintaining our culture as we scale. Bob’s measures employee engagement as a key driver of employee loyalty, belief in Bob’s mission, and employee job satisfaction. Employee engagement has steadily increased since we first began measuring it in 2022.

Bob’s is guided by a highly skilled and driven executive leadership team, whose acumen and industry knowledge have been essential in shaping our brand, advancing our company’s progress, and ensuring our adaptability to market dynamics. Empowered by a legacy of collaborative innovation and relentless pursuit of excellence, our company’s noteworthy achievements have garnered widespread recognition. Important accolades include:

•July 2025: Recognized on Newsweek List of America’s Best Retailers 2025

•April 2025: Named one of America’s Most Trustworthy Companies

•January 2025: Recognized by Forbes for Best Customer Service for 2nd consecutive year

•December 2023: Awarded Furniture Industry Leadership by Furniture Today

OUR GROWTH STRATEGIES

We believe we have a clear opportunity to drive sustainable growth and profitability by executing on the following strategies:

Grow Store Base Across New and Existing Markets

We believe that our compelling value proposition and the success of our stores across a broad range of geographic regions, population densities and demographic groups creates a significant opportunity to profitably increase our store base. Bob’s unit expansion story is underpinned by a strategic, data-driven playbook. With a 12 to 18 month opening cycle, we have institutionalized a development process that balances speed with disciplined ROI evaluation and has powered our expansion across 26 states. Each store opening is supported by rigorous site selection, merchandising alignment and operational planning, creating a repeatable development process that has delivered consistent returns. We believe there is a clear and actionable path to more than 500 stores in our existing format nationwide by 2035, representing 2.5 times our current store base.

Our new store expansion model is guided by a disciplined opportunity assessment that prioritizes market-level profitability, supply-chain-enabled contiguous expansion, brand awareness, competitive positioning, pricing advantages and regional relationships. We target AUVs of approximately $9 million and cash-on-cash returns exceeding 80% within five years for our new store formats with a payback period of approximately two years. We leverage broad data analytics, on-the-ground insights and hindsight learnings from our nearly 35-year history to inform future strategic decisions and ensure success. We expect to balance expansion in new markets with high-density growth in existing markets, creating a durable and diversified path to increasing our national scale.

Grow Stores In Existing Markets

Our long-standing legacy markets in the Northeast, including New York, demonstrate the strength of our brand and the benefits of scale. In our existing markets, Bob’s growing store density has continued to unlock meaningful cost and operational advantages driven by efficiencies in marketing and brand recognition and streamlined supply chains. Our in-fill strategy is highly contiguous, densifying existing and adjacent markets to enhance existing store-level economics and provide a runway for sustainable growth.

As an example of our growth in existing markets, we have grown Philadelphia from four units in fiscal year 2014 to 13 units as of June 29, 2025. Over the same period, we have expanded our aided brand awareness in the Philadelphia market significantly to upwards of 78% and our profitability metrics have more than doubled.

9

Grow Stores In New Markets

We have achieved success and demonstrated portability across geographic regions. Our momentum gives us confidence that we can continue expanding beyond newly opened and existing markets. For example, we successfully expanded into the Midwest region in fiscal year 2016 and the West Coast in fiscal year 2018, and more recently the Southeast region through our North Carolina openings in fiscal year 2025. We believe that our regional expansion demonstrates the broad resonance of our model and value proposition. In each new market, brand awareness has scaled quickly, reinforcing our confidence in our ability to replicate our success and drive efficiencies in advertising, supply chain and fixed costs. Each new store opening is followed by extensive testing and hindsight analysis, allowing us to refine our expansion and marketing playbooks and learn from every experience.

As an example of our new market expansion success, we entered Los Angeles in fiscal year 2018 with six units and an aided brand awareness of 24%, based on a third-party data collection provider. We currently have 17 units in Los Angeles and have more than doubled our aided brand awareness and revenue. Our profitability metrics in Los Angeles have expanded to our mature store average. As we continue to infill stores in Los Angeles, we expect to continue to gain market share and drive further cost efficiencies.

Drive Comparable Sales

We have a broad array of foundational and newly created initiatives that we believe will continue to increase our comparable sales by strengthening brand awareness, increasing conversion, optimizing our regionalized zone pricing and product assortment, and further deepening our relationship with our customers by leveraging technology.

Strengthen Brand Awareness

Our aided brand awareness in our top 10 designated market areas averaged approximately 71% in fiscal year 2024 whereas our national aided brand awareness was approximately 45%. We believe this speaks to the large opportunity in continuing to reach customers with our unique value proposition. Bob’s aided brand awareness has more than doubled since fiscal year 2018, supported by enhanced marketing capabilities and a differentiated value proposition that resonates with a diverse customer base. According to our internal metrics, our brand scores have improved materially across key metrics since fiscal year 2018: +112% in consideration, +178% in reputation, and +77% in brand buzz.

We use a variety of marketing channels and tactics to reach our customers. Bob’s is well-known for our fun, whimsical advertising that features “Little Bob”, intended to create a memorable and lighthearted presence, moving away from the serious, high-end image of traditional furniture stores. Our “out-of-the-box” approach to unique campaigns infuses a playful element of surprise and humor, helping us to more authentically connect with our target audience. Our distinctive brand personality comes alive through high-impact television and digital campaigns, such as:

•Viral social media and advertising initiatives that generated 2.9 billion impressions in the second quarter of fiscal year 2025

•Our classic Oh My Bob! campaign in fiscal year 2024 highlighting the value appeal of our products in the memorable and fun Bob’s tone generated over 70 million views during the Spring 2025 campaign

•Our industry-first social reality series in fiscal year 2025, Till Décor Do Us Part, resulting in highly positive sentiment that generated 79 million views, 132 million impressions and 15% higher click through rate since launch in July 2025

•Strategic collaborations with local influencers and brands, including a Bob’s branded NASCAR vehicle as we entered North Carolina, which significantly enhanced market aided brand awareness by 64% since the

10

beginning of fiscal year 2024 and garnered 250 million media impressions during the period beginning May 12, 2025 to August 31, 2025

Little Bob is the brand’s fun-loving and memorable “spokes-puppet.” He appears in much of our advertising to elevate attribution and recall. Originally conceived as founder Bob Kaufman’s avatar, Little Bob has evolved over the years to embody many of the fun and wholesome attributes of the brand.

Our marketing initiatives help boost brand awareness and drive customer traffic to our showrooms and website, which we believe in turn serves as a powerful catalyst for deepening customer engagement and loyalty.

11

Increase Conversion

We are constantly refining and optimizing our operations to increase conversion. We leverage real-time data and past learnings to turn tactics into a cohesive, consistent and sustainable plan across our national retail experience, talent management, and technical capabilities. We track a number of operational KPIs that highly correlate with revenue growth, including close rate by associate, OmniCart attachment rate, schedule effectiveness and training milestones. Our in-store technology platform enables retail leadership teams and store-level managers to track our operational KPIs through real-time dashboards, which enable nimble reallocation of resources and assessment of under and overperformance.

We empower regional leaders and invest in guest experience specialists. We have a robust talent pipeline that is further enhanced by continuous employee learning and development programs, fair compensation and incentives, and great store management teams. Our store associate training leverages conversion KPIs and individual performance rankings to enhance insights, coach more effectively and elevate overall team performance. Guest experience specialists offer personalized clienteling, so that each customer feels valued and understood. Our hiring and training excellence has assisted us in consistently increasing store conversion year after year.

Our showrooms are designed to deepen customer engagement through easy-to-navigate store layouts, seasonal floor resets, and café amenities, making furniture shopping enjoyable and hassle-free, which we believe in turn increases conversion. Our in-store technology enables guest experience specialists to leverage real-time stock, delivery and financing information, supported by digital shopping carts that flow seamlessly from the showroom to online, and vice versa. As we build out our technological capabilities further, we expect to generate greater process efficiencies and increase sales conversion.

Optimize Zone Pricing And Regional Assortment

Bob’s value proposition and product architecture allows us to provide a product for the vast majority of customers. We believe that our product architecture is a unique competitive advantage and we have an opportunity to further expand that strength through sophisticated zone pricing and clustered assortment capabilities.

Our everyday low price promise is supported by a sophisticated pricing strategy. Our zone pricing capabilities, which began in the fourth quarter of fiscal year 2023, are designed to help us align with local demand and purchasing power, while also enabling us to consistently offer products priced below our competitors. We track national, regional and local competitors on pricing across product categories to maintain our leading value proposition. By further strategically adjusting price points based on regional economic conditions and customer behavior, we seek to optimize our profitability while maintaining our commitment to delivering value without compromise.

Our approach to product assortment utilizes data-driven insights from real-time sales to help us better manage inventory. Our assortment “newness” is a key growth lever. By integrating new products, representing approximately 15% to 30% of our showroom product offering each year, we seek to continue to drive repeat purchase demand and brand relevance. While a majority of our products are consistent across all stores, in the first quarter of fiscal year 2024, we began to test targeted and limited localized product assortments tailored to the specific preferences and tastes of certain markets. We are pleased with initial customer responses, which builds our confidence in a broader identification and rollout of clustered opportunities. For example, we cater to our Manhattan customers by focusing on small space living furniture and exclude large sectional pieces that are not ideal for city apartments. Aligning closely with local customer preferences allows us to increase AOV and more efficiently leverage supply chain efficiencies, driving margin accretion.

Deepen Customer Relationships Through Technology

Bob’s is designed to meet customers wherever they choose to engage. Our upgraded website, refreshed in 2023, enables fast and easy shopping with intuitive post-order self-service. Digital investments have enabled real-time cart continuity (OmniCart), AI-driven search, and virtual product visualization. Our BobSquad virtual sales team and BobBot post-order chatbot support high engagement and seamless handoff across eCommerce channels.

12

Bob’s leverages customer data in a variety of ways to ensure strategic, cross-functional decisions and to drive interest, conversion, and loyalty. Through our enriched customer database, we conduct in-depth analyses on our customer composition and behavior to draw valuable insights. These insights support decisions and assist in project prioritization, such as identifying marketing opportunities, capitalizing on merchandising trends and informing real estate analysis and planning. In addition, we leverage our customer data as part of our audience strategy and customer relationship management functions. For example, we develop lookalike modeling for paid media targeting and leverage our existing customer base to drive retention through email, SMS and direct mail marketing which we believe drives meaningful traffic and conversion.

Leverage Scale to Expand Margins and Drive Efficiency

We are making focused investments to efficiently drive top-line growth and margin expansion. Our margin expansion opportunities include expanding product cost margins, increasing marketing efficiencies, achieving supply chain optimization and leveraging fixed costs.

Strategic Sourcing

We continue to deliver strong and expanding product cost margins, underpinned by our operational discipline and deep vendor relationships. As we continue to scale and expand our sourcing relationships with vendors, we anticipate merchandise margin improvements, reflective of better terms, volume-based efficiencies, and increased vendor demand for our business. As of June 29, 2025, we have pivoted our supply chain completely out of China to avoid prior tariff impacts on our margins. We remain nimble and plan to proactively address incremental tariff impacts to further support continued margin expansion.

Marketing Efficiencies

Our rising retail density across existing and new markets is amplifying our brand visibility. As we pivot more towards national advertising, we continue to unlock meaningful leverage from our marketing budget. Additionally, our AI-powered targeting has enabled more precise audience engagement and has driven an approximately 50%+ improvement in return on advertising spend since fiscal year 2019. Bob’s has proven that we take meaningful market share when we enter a new market given our unique value proposition which resonates with customers. As our overall brand awareness continues to scale, we believe we will continue to drive increased marketing efficiencies and lower our overall customer acquisition costs.

Supply Chain

As we continue to scale, we expect to be able to drive efficiencies across every aspect of our supply chain, including ensuring container availability, increased purchasing power with our freight vendors to reduce ocean shipping costs, reducing trucking and depots costs per order and in order to make furniture delivery to our customers more efficient. We plan to continue diversifying our supply chain network as we expand, allowing for improved utilization of our existing distribution centers and reducing overall costs.

Fixed Costs

Our existing infrastructure across field management and corporate overhead supports growth without linear cost escalation. Our corporate staff is structured to maintain effective oversight at its current level, and we believe that our model has the capacity to support future growth while simultaneously leveraging benefits from expanding scale. We anticipate gaining additional operational benefits as we continue to densify and grow our overall national penetration.

These elements provide a foundation for continued success and ongoing operating efficiencies as we scale. We will continue to make strategic investments in our infrastructure to improve operational efficiency and prepare for the next stage of our growth.

13

Summary of Risks Related to Our Business

An investment in our common stock involves a high degree of risk. Among these important risks are the following:

•We are subject to risks associated with our reliance on foreign manufacturing, suppliers and imports for our products.

•We face significant competition from national, regional and local retailers of home furnishings.

•If we fail to successfully anticipate or respond to changes in consumer preferences in a timely manner, our sales may decline.

•Our business, results of operations and financial condition may be adversely affected by global economic conditions and the effect of economic pressures and other business factors on discretionary consumer spending and consumer preferences.

•If we fail to successfully manage the challenges that our planned new store growth poses or encounter unexpected difficulties or higher costs during our expansion, our operating results and future growth opportunities could be adversely affected.

•Our business requires that we lease substantial amounts of space and there can be no assurance that we will be able to continue to lease space on terms as favorable as the leases negotiated in the past.

•We are dependent upon the ability of our third-party suppliers to meet our requirements; any failures by these producers, or the unavailability of suitable suppliers at reasonable prices or limitations on our ability to source from third-party vendors may negatively impact our ability to deliver quality products to our customers on a timely basis or result in higher costs or reduced net revenues.

•Any disruption in our distribution capabilities, supply chain or our related planning and control processes may adversely affect our business, financial condition and operating results.

•Failure to comply with data privacy and security laws and regulations could adversely affect our operating results and business.

•If our efforts to protect the privacy and security of information related to our customers, us, our employees, our associates, our suppliers and other third parties are not successful, we could become subject to litigation, investigations, liability and negative publicity that could significantly harm our reputation and relationships with our customers and adversely affect our business, financial condition, and operating results.

•Our intellectual property rights are valuable, and any failure to protect them could reduce the value of our products and brand and harm our business.

•Federal, state or local laws and regulations, or our failure to comply with such laws and regulations, could increase our expenses, restrict our ability to conduct our business and expose us to legal risks.

•Because Bain Capital owns a significant percentage of our common stock, it may control all major corporate decisions and its interests may conflict with your interests as an owner of our common stock and our interests.

•The other factors set forth under “Risk Factors.”

Before you invest in our common stock, you should carefully consider all the information in this prospectus, including matters set forth in the section titled “Risk Factors.”

14

Corporate Information and Structure

BDF Holding Corp. was formed as a Delaware corporation on December 20, 2013 and is the issuer of our common stock offered by this prospectus. The Company does not conduct any operations other than with respect to its direct and indirect ownership of its subsidiaries, and the business operations of Bob’s are conducted primarily out of its indirect operating subsidiaries.

Our principal executive offices are located at 434 Tolland Turnpike, Manchester, CT 06042, and our telephone number at that location is (860) 474-1200. Our website address is www.mybobs.com. Our website and the information contained on our website do not constitute a part of this prospectus.

Our Principal Stockholder

Upon the closing of this offering, BCPE BDF Investor, LP, an investment fund advised by Bain Capital, will beneficially own approximately % of our common shares (or % if the underwriters exercise in full their over-allotment option). As a result, we will be a “controlled company” within the meaning of the applicable listing rules of . See “Risk Factors—Risks Related to Ownership of our Common Stock and this Offering—Following the consummation of this offering, we will be a “controlled company” within the meaning of the rules of and, as a result, will qualify for, and may rely on, exemptions from certain corporate governance requirements; you will not have the same protections afforded to stockholders of companies that are subject to all such requirements.”

Bain Capital

Founded in 1984, Bain Capital, L.P. is one of the world’s leading private investment firms, with approximately $185 billion in assets under management. Bain Capital, L.P. is committed to creating lasting impact for its investors, management teams, businesses, and the communities in which it operates. As a private partnership, Bain Capital, L.P. leads with conviction and a culture of collaboration—advantages that enable it to innovate investment approaches, unlock opportunities, and create exceptional outcomes. The firm’s global platform invests across five focus areas: Private Equity, Growth & Venture, Capital Solutions, Credit & Capital Markets, and Real Assets. In these focus areas, Bain Capital, L.P. brings deep sector expertise and wide-ranging capabilities to each of these areas, supported by more than 1,850 employees across 25 offices on four continents.

Since its founding, Bain Capital Private Equity has made over 400 investments in companies in a variety of industries around the world. The firm has a long and successful history of investing in consumer products, restaurants and retail businesses and has partnered with management teams to complete numerous initial public offerings in these sectors, including Virgin Australia, Canada Goose, Michaels, Burlington Holdings, Bright Horizons, BRP, Bloomin’ Brands, Dunkin’ Brands, and Dollarama.

Implications of being a Controlled Company

Immediately after the completion of this offering, investment funds advised by Bain Capital will own approximately % of our outstanding common stock (or approximately % of our outstanding common stock if the underwriters’ option to purchase additional shares from us is exercised in full). As a result, we expect to be a “controlled company” within the meaning of the corporate governance standards of . Under the corporate governance standards, a company of which more than 50% of the voting power is held by an individual, group or another company is a “controlled company” and may elect not to comply with certain corporate governance standards, including (i) the requirement that a majority of the board of directors consist of independent directors, (ii) the requirement that we have a compensation committee that is composed entirely of independent directors and (iii) the requirement that our director nominations be made, or recommended to our full board of directors, by our independent directors or by a nominations committee that consists entirely of independent directors. We may take advantage of certain of these exemptions, and, as a result, you may not have the same protections afforded to stockholders of companies that are subject to all of the corporate governance requirements. In the event that we cease to be a “controlled company,” we will be required to comply with these provisions within the transition periods specified in the corporate governance rules. See “Management—Controlled Company.”

15

The Offering

Common stock offered by us | shares. | ||||

Option to purchase additional shares | We have granted the underwriters an option to purchase up to additional shares of our common stock within 30 days of the date of this prospectus. | ||||

Common stock to be outstanding after this offering | shares (or shares if the underwriters exercise their option to purchase additional shares in full). | ||||

Use of proceeds | We estimate that the net proceeds from the sale of shares of our common stock offered by us in this offering will be approximately $ million, or approximately $ million if the underwriters exercise their option to purchase additional shares in full, based on an assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds from this offering for general corporate purposes. See “Use of Proceeds.” | ||||

Dividend policy | We do not currently pay dividends and do not currently anticipate paying dividends on our common stock in the future. However, we expect to reevaluate our dividend policy on a regular basis following the offering and may, subject to compliance with the covenants contained in our credit facilities and other considerations, determine to pay dividends in the future. See “Dividend Policy.” | ||||

Risk factors | Investing in our common stock involves a high degree of risk. You should read the “Risk Factors” section of this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our common stock. | ||||

Controlled Company | Immediately after the completion of this offering, investment funds advised by Bain Capital will own approximately % of our outstanding common stock (or approximately % of our outstanding common stock if the underwriters’ option to purchase additional shares from us is exercised in full). As a result, we expect to be a “controlled company” within the meaning of the corporate governance standards of . See “Management—Controlled Company.” | ||||

Proposed stock exchange symbol | “ ” | ||||

The number of shares of common stock to be outstanding after this offering is based on shares of common stock outstanding immediately prior to this offering, and excludes shares of common stock reserved for future issuance under our equity incentive plans.

Unless otherwise indicated, information presented in this prospectus gives effect to the following:

•an assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus;

•a -for- split of our common stock effected on ;

•the effectiveness of our second amended and restated certificate of incorporation and our second amended and restated bylaws, upon the closing of this offering; and

•no exercise by the underwriters of their option to purchase up to additional shares of our common stock in this offering.

16

Summary Historical Consolidated Financial Data

We present below our summary consolidated statements of operations and of cash flow data for the fiscal years ended December 29, 2024, December 31, 2023 and January 1, 2023, and our consolidated balance sheet data as of December 29, 2024. We have derived this information from our audited consolidated financial statements included elsewhere in this prospectus.

The historical results presented below are not necessarily indicative of the results to be expected for any future period. You should read the summary consolidated financial and operating data presented below in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our audited consolidated financial statements and related notes included elsewhere in this prospectus.

| Fiscal Year Ended | |||||||||||||||||

| (in thousands, except share and per share amounts) | December 29, 2024 | December 31, 2023 | January 1, 2023 | ||||||||||||||

| Net revenues | $ | 2,028,143 | $ | 2,008,082 | $ | 2,105,508 | |||||||||||

| Cost of sales | 1,079,703 | 1,073,355 | 1,252,072 | ||||||||||||||

| Gross profit | 948,440 | 934,727 | 853,436 | ||||||||||||||

Operating expenses | |||||||||||||||||

| Selling, general, and administrative | 813,302 | 806,938 | 793,887 | ||||||||||||||

| Pre-opening expenses | 15,326 | 4,662 | 9,565 | ||||||||||||||

| Loss on disposal of fixed assets | 17 | 2,226 | 28 | ||||||||||||||

| Impairment of long-lived assets | 2,061 | 1,322 | — | ||||||||||||||

| Restructuring charges | — | 1,760 | — | ||||||||||||||

| Total operating expenses | 830,706 | 816,908 | 803,480 | ||||||||||||||

| Operating income | 117,734 | 117,819 | 49,956 | ||||||||||||||

Other (income) expense | |||||||||||||||||

| Interest expense | 10,538 | 19,872 | 24,343 | ||||||||||||||

| Interest income | (2,450) | (1,006) | (638) | ||||||||||||||

| Other income, net | (3,778) | (3,665) | (8,488) | ||||||||||||||

| Total other expense, net | 4,310 | 15,201 | 15,217 | ||||||||||||||

| Income before taxes | 113,424 | 102,618 | 34,739 | ||||||||||||||

| Income tax expense | 25,491 | 24,519 | 7,091 | ||||||||||||||

| Net income | $ | 87,933 | $ | 78,099 | $ | 27,648 | |||||||||||

| Basic net income per share | $ | 0.51 | $ | 0.46 | $ | 0.16 | |||||||||||

| Diluted net income per share | $ | 0.50 | $ | 0.44 | $ | 0.16 | |||||||||||

Fiscal Year Ended | |||||||||||||||||

(in thousands) | December 29, 2024 | December 31, 2023 | January 1, 2023 | ||||||||||||||

Consolidated statement of cash flow data: | |||||||||||||||||

Net cash provided by operating activities | $ | 161,154 | $ | 197,172 | $ | 51,993 | |||||||||||

Net cash used in investing activities | (78,224) | (22,773) | (49,733) | ||||||||||||||

Net cash used in financing activities | (105,469) | (94,527) | (89,749) | ||||||||||||||

Net (decrease) increase in cash and cash equivalents | $ | (22,539) | $ | 79,872 | $ | (87,489) | |||||||||||

17

| December 29, 2024 | |||||||||||

(in thousands) | Actual | As Further Adjusted(1)(2) | |||||||||

Consolidated balance sheet data | |||||||||||

Cash and cash equivalents | $ | 80,558 | |||||||||

Total assets | 1,625,064 | ||||||||||

Total operating and financing lease liabilities, including current portion | 691,097 | ||||||||||

Total stockholders’ equity | 464,230 | ||||||||||

Key Performance Indicators and Non-GAAP Financial Measures(3)(4) | Fiscal Year Ended | ||||||||||||||||

(in thousands, except percentages and number of stores) | December 29, 2024 | December 31, 2023 | January 1, 2023 | ||||||||||||||

| Adjusted net income | $ | 90,754 | $ | 83,239 | $ | 23,803 | |||||||||||

| Adjusted EBITDA | 193,994 | 195,037 | 117,752 | ||||||||||||||

Comparable sales growth | (3.4) | % | (7.4) | % | 0.4 | % | |||||||||||

Number of new stores opened | 19 | 7 | 14 | ||||||||||||||

| Number of stores at period end | 189 | 171 | 164 | ||||||||||||||

______________

(1)Adjusted to give effect to (i) the effectiveness of our second amended and restated certificate of incorporation and our second amended and restated bylaws, upon the closing of this offering and (ii) the issuance of shares of common stock by us in this offering and the receipt of approximately $ million in net proceeds to us from the sale of such shares, assuming an initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

(2)Each $1.00 increase or decrease in the assumed initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus, would increase or decrease, as applicable, each of our as further adjusted cash and cash equivalents, total assets and total stockholders’ equity by approximately $ million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. Similarly, each increase or decrease of 1.0 million in the number of shares offered by us would increase or decrease, as applicable, each of our as further adjusted cash and cash equivalents, total assets and total stockholders’ equity by approximately $ million, assuming that the assumed initial public offering price remains the same, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. The as further adjusted information discussed above is illustrative only and will adjust based on the actual initial public offering price and other terms of this offering.

(3)Adjusted net income and Adjusted EBITDA are non-GAAP financial measures. The reconciliations to the most comparable GAAP financial measures and a discussion of the rationale for the presentation of these items are provided in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Performance Indicators and Non-GAAP Financial Measures” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Reconciliation of Non-GAAP Financial Measures.”

(4)Our KPIs are discussed and defined in the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

18

Risk Factors

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this prospectus, including in the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and in our audited consolidated financial statements and the related notes elsewhere in this prospectus, before making an investment decision. The risks and uncertainties set out below are not the only risks we face. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial also may materially and adversely affect our business, financial condition, results of operations, liquidity and stock price. If any of the following events occur, our business, financial condition, and operating results could be materially and adversely affected. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Related to Our Business

We are subject to risks associated with our reliance on foreign manufacturing, suppliers and imports for our products.

We procure the majority of our products from suppliers located outside of the United States. As of September 10, 2025, our primary sourcing markets are Vietnam and the United States, representing approximately 65% and 25% of our product cost volume, respectively, with smaller sourcing markets in Thailand, Malaysia and Cambodia. As a result, our business depends on global trade, as well as trade and other factors that impact the specific countries where our suppliers’ production facilities are located. Our future success will depend in large part upon our ability to maintain our existing foreign supplier relationships and to develop new ones based on the requirements of our business and any changes in trade dynamics that might dictate changes in the locations for sourcing of products. While we rely on long-term relationships with many of our suppliers, we have no long-term contracts with them and generally transact business with them on an order-by-order basis.